I am pleased to present this lender’s case study which was submitted to me by Donald Rudnik, whose full contact info is listed at the bottom of this post. This is written from the lender’s viewpoint and recounts the buyout of a bigger company by a smaller company, both underperforming. This will help the typical buyer get into the lender’s head. The big takeway from this is how an apparently deteriorating company can even presume to get in the door of a conglomerate much less buy one of its subs that is five times its size.

Actually this can happen more often that you think. I have been in a number of deals sold by big conglomerates. They often just dump their unwanted companies on the market for nothing and they can be loaded with assets. Believe it or not even the smallest of buyers can buy them in many cases – I have been one. In fact I would encourage individuals and small businesses that are buyers to keep an eye out for deals originating from big private as well as public holding companies. It could make your decade.

So I trimmed this case study down a little to make it manageable and I will insert some anecdotal comments and thoughts I have about the process whenever I can’t resist.

SMALL COMPANY BUYS MUCH LARGER DISTRESSED COMPANY

This loan case is about a smaller break-even company buying a 5X larger company that was losing money.

CASE PROFILE

A Niche lender funded a $3,000,000 loan to a company marginally above break-even to buy a much larger company in financial difficulty. The lending facility included accounts receivable and inventory lines of credit with purchase order financing back-up for post acquisition needs.

ACQUIRER

The Specialty Manufacturer Company with $10 MM in annual revenue with an EBITDA-low six figures. The company had reached maximum potential. It required an acquisition as to not grow was to ensure eventual failure. Improving efficiency with costly new equipment with its’ modest cash flow was not feasible. There were no unpledged assets or under-loaned assets corporately or personally. There was $100,000 set aside for costs/cash infusion.

When a larger quasi-competitor was found, negotiations quickly began.

Note the very low EBITDA, low six figures. For a $10mm company this is horrible and usually means they have a negative cash flow. Note also the $100k, which is apparently the equity contribution. Keep this number in mind as we see the total transaction size.

TARGET

A Conglomerate was selling or liquidating due to inconsequential size, recent losses, and the product not fitting into the future goals. The company was several states away and sales were 5X acquirer with losses in low mid-seven figures. This company’s sales were in decline.

The company had desirable equipment (for this acquirer) but management skills appeared to be limited. There was no bank debt or accounts payable of consequence, as the obligations were paid by the conglomerate.

The price was high (well above asset value and needing mezzanine funding) and importantly seller adamantly refused to consider of seller financing.

The price above asset value and needing mezz would have sent me reeling.

LENDER ISSUES

ACQUIRER

The local bank of acquirer was content with its fully secured loan. As stated, there was no excess loan availability. Also with the target several states over bank saw no reason to approve any new lending facilities. Also the bank (as all others) wanted 25%-40% equity in the new transaction when only low 6 figures (10-13%) were available.

It seems $100k is available, I don’t know if this will be even close to 10-13%.

LOCAL BANK/TARGET

There had not been a lending relationship with the company since it was acquired by the conglomerate years prior. Without the support of the conglomerate, there was little interest by local banks for lending to an unknown acquirer, a long distance away, with limited equity.

National non-bank lenders were not interested due to targets losses

So it isn’t really bankable. What do you expect with losses?

TIMING

Two lenders went to audit (paid by acquirer) only to decline the loan. The time frame was now down to three weeks, the price remained firm and there was no seller funding offered The liquidation of the (target) company appeared imminent as there were others who showed interest should acquirer fail had ceased to be an option.

NICHE LENDER

The Asset Based Lender, convinced of acquirer’s ability to rapidly make changes needed to make the acquisition profitable, approved the loan.

The collateral supported a loan of approximately 2/3 of acquisition price. The lender convinced the conglomerate it had unrealistic view of the liquidation value. Its cash needs had been exaggerated and enough seller financing was made available to close the acquisition.

Everyone, I mean Everyone. Every seller, every conglomerate, you name it. They all have an unrealistic view of liquidation. Certainly if I were selling a company I would purposely have an inflated view of liquidation. But it is the most common disease a seller can have and you must cure him of it. They will always compare the deal on the table to their dream of liquidating the assets on the open market at full replacement value or fair market or whatever. The lender was a big help to bang down the seller on the liquidation value.

The post acquisition loss reduction strategy deserves summary:

Management of the target were overpaid by market standards. The goal seemed to be sales not operational efficiency/profitability. Several management reductions produced significant cost cuts.

Target company up-streamed fees in mid six figures to conglomerate (and were eliminated on acquisition).

Management fees, us dealmakers always take them but they are the first to go when things get tough.

Closing one of the target’s production lines produce overall savings of mid six figures.

Sale of the equipment on closed production line produced cash post closing (not as much as conglomerate projected when it decided to sell).

Transferring approximately 1/5 of target’s production to acquirer location and 1/3 of acquirer to target’s location produced higher margins immediately.

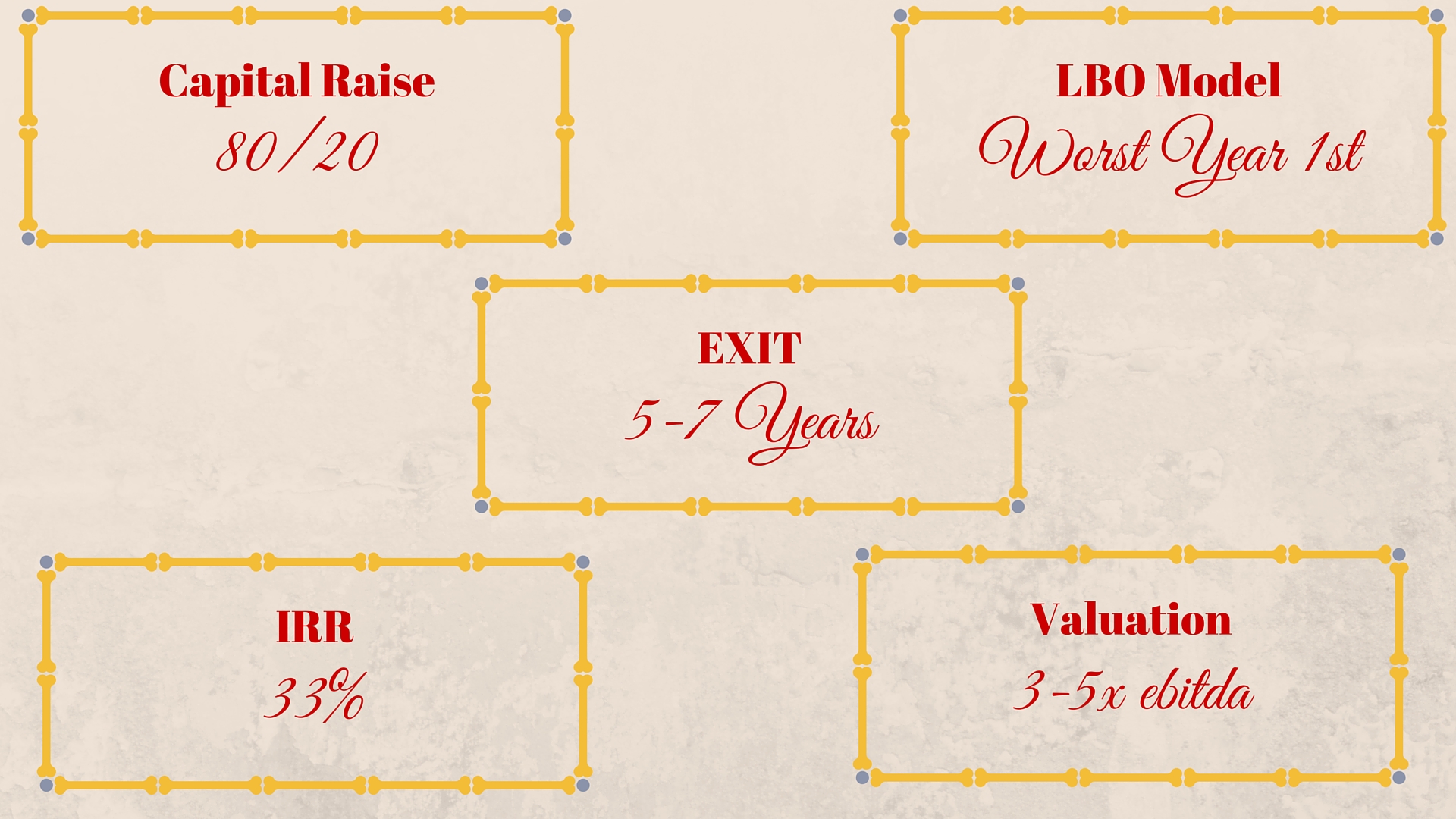

CAPITAL STRUCTURE

The owners’ equity was mostly used in audit and legal fees and for some working capital post closing.

The Lender in accepting non bank risks and having non bank flexibility charges non-bank rates. The prime rate at the time was 8% at the time and all in costs the APR was nearly 18%. The account receivable advance rate was 85% and the inventory advance rate including work in process 50%. The equipment had some back up collateral value, not enough to make any difference in lending format. It was a one year note without trip wire covenants such as minimum net worth, minimum working capital, and other restrictive conditions other lenders routinely require. There was no success fee nor having a seat on Board of Directors.

So as we can see the $100k equity is pretty much all acquisition costs against the total transaction size of $8mm.

Seller provided an interest only loan for two years with five year amortization/balloon.

Niche Lender $3,000,000 at 18% or 6.75%

Seller $5,000,000 at 6% or 3.75%

Total $8,000,000 Blended 10.50 % (or in effect Prime + 2.5%)

As niche lender had neither back end fees nor seat on Board of Directors.

From niche lender’s view, the Company has the following strengths:

-The manufacturing niche not easily replaceable overseas with the very

demanding just in time production needs of its’ clientele.

-The product was routinely modified, but will not soon become obsolete

-A single owner could accomplish major operational changes.

-No major tax or accounts payable issues at closing

-Costs cuts and blended rate of funding did not put stress on

profitability or cash flow.

As a result of niche lender’s funding, the Company can now make better decisions by having a stable funding source as part of the business acquisition turnaround plan. The results of the predictable aggressive funding had a near immediate impact on sales and profitability.

So in summary here is a deal done with $3mm in asset based financing, $5mm in seller financing and pretty much zilch in equity in the deal. Essentially 37% down payment. It’s ok because there were plenty of assets to cover the lender. The seller note is fairly short term and will have to be dealt with but if the changes to the bottom line take hold then the deal can fly. Quite frankly I have seen conglomerates dump deals on the market for a whole lot less and not try to play hardball on the price. This deal appeared expensive to me but the proposed changes provide the justification for the loan and the buyout.

While this deal was done between two similar companies with apparent synergies, they had quite a few things going against them, mainly they couldn’t make any money. But these guys only had to come up with pocket change to do the deal so could it have been done by an individual or financial buyer? Sure, but it sure helps if the post acquisition plan is in place as it is in this example. You don’t want to be buying it without knowing what changes need to be made to restore profitability.

Many thanks to Don Rudnik for this enlightening case study.

The source is the HANDBOOK OF FINANCING GROWTH–Wiley Finance edition 2009 pages 344-347. There are four other loan cases provided and an interview on factoring by Donald M. Rudnik-Senior Business Development Officer–Sterling Commercial Credit.

Donald M. Rudnik-Senior Business Development Officer-Sterling Commercial Credit Phone: 773-771-9251 or 773-298-0595 don@sterlingcommercialcredit.com