One of the reasons I stuck with small business buying is that big business buying didn’t make a lot of sense to me. First of all there is competition and the competition comes from big money players in private equity. So these guys are at the top of the food chain and ever since the 1990’s they have grown in numbers like rabbits. So there is more institutional money available to chase deals. They chase deals that are big… usually. Lately they reach down to our level but that won’t get them the return they need.

Which leads me to my second point which is that there are fewer big deals than small deals. That will always be the case. I never liked the idea of having too few deals to pick from. Not only are the small deals more numerous, but the small deals are often not bought, leaving them available to buy for long periods of time.

My third point is that the big deals are all publicized and unapproachable. The small deals are often not even on the market and are easy to approach by direct contact, bypassing all the noise. Just try to get a look at a $10mm EBTIDA deal and you will be grilled under heat lamps and made to spill your guts to the intermediaries.

My fourth and last point is that the bigger the deal the more complicated it gets and you may as well get your MBA from Harvard to figure them out. Which is why it is impossible to get an investment banking job without a top level degree. Does this put it all out of reach? Not at all. We can learn from the big markets and they can learn from us. More importantly we can take the most useful techniques from the big market and simplify them while eliminating the unnecessary ones.

So I will go over a few of the techniques(myths) here and most of them are, with some modifications, useful to use on smaller deals. I will also point out the areas of overcomplication and indicate how we can oversimplify them.

The Myths of Investment Banking

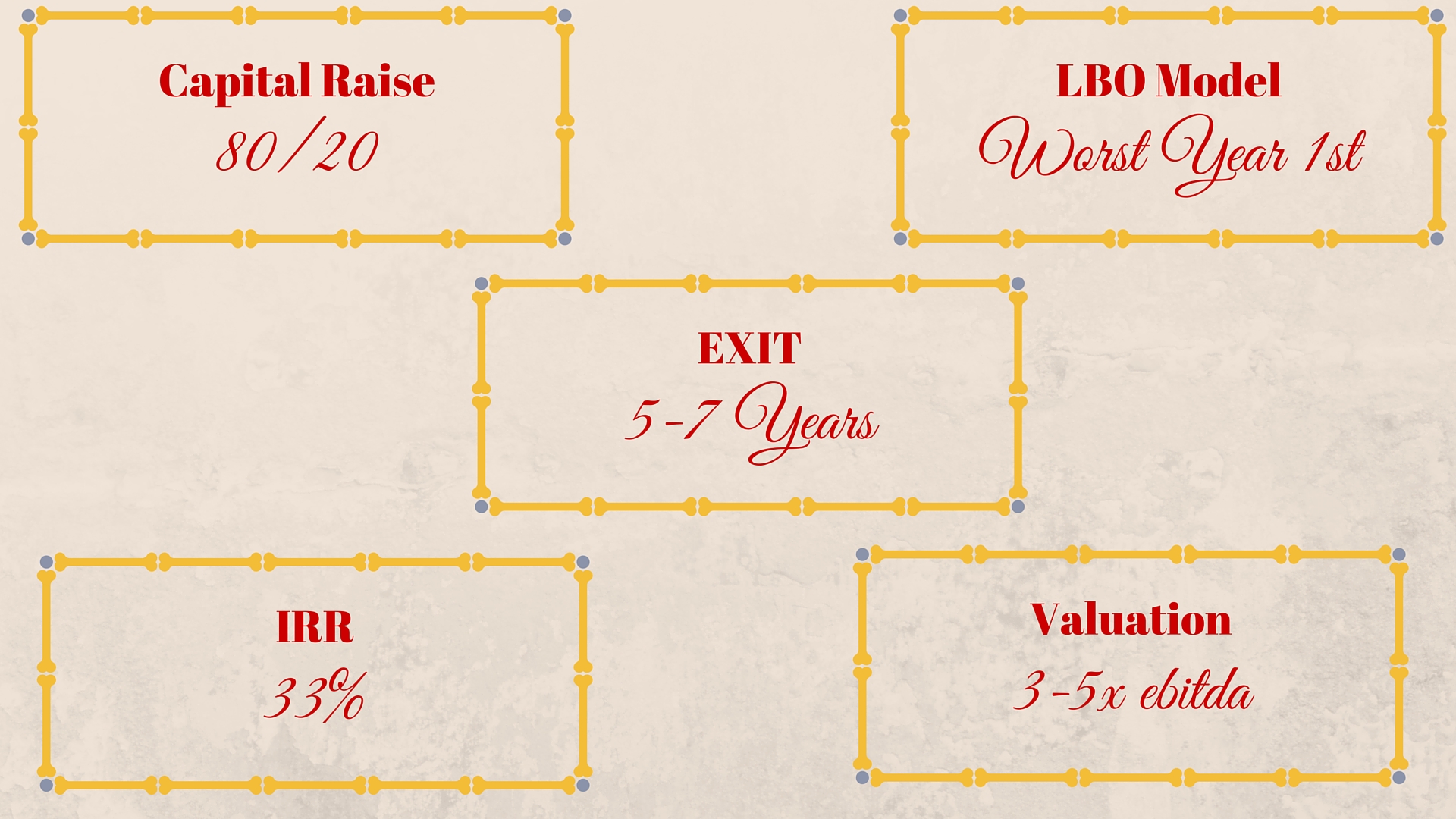

- Raising Capital. The big guys raise capital from institutions using a cookie cut compensation plan. It goes like this, and this goes for hedge funds too The 80/20 Rule of Limited Partnerships. The general partner (that is you, the dealmaker) gets 20% (the carried interest) of the equity and the investors get 80%. This is simple. What is also simple is the 1-2% management fees that are paid on top of that. In fact, according to Warren Buffet, the management fees are the main source of income. The equity is just gravy since most managers are bad and won’t achieve superior returns. What isn’t simple is all the nuances and variations of this compensation structure. We need not get into the nuances but here is what you should know. When taking on investors, in small deals start in reverse and allow yourself to be talked down. 80% you get, 20% the investors gets. The reason is simple, you will have skin in the game and the PE shop never does. Keep controlling interest if at all possible.

- Valuation. The are dozens of ways to value a company. Most of them are useless in small deals. As I look at typical investment banked deals I see the very common discounted cash flow model routinely. While that may be fine for big deals it relies on overoptimistic projections in most cases. In small deals we always assume that projections are useless because the performance going forward will be flat at best. That doesn’t mean the target company cannot grow, it means we have no idea what the target company will do because the income stream is never predictable. This is true for big companies too but they are just able to convince investors to value “forward looking” numbers. Stick with simple multiples of EBITDA, weighting the years as needed to minimize the valuation. Is this unfair? No, it is simply Murphy’s law. The worst year is likely to be the most accurate predictor of the future.

- Holding Periods. For purposes of my deal criteria somebody might ask me about holding periods for my deals and I might say it is usually 5-7 years. But this is a lie. I would flip it the next day at a huge profit if I could but more likely I will be stuck with it forever. While big companies may well be more liquid and be able to achieve an exit in five years, not only is there no guarantee, but the success of that plan depends on a lot of factors. Moreover, the PE owners have hurdle rates to worry about — the need to make sure there is a sufficient return to keep investors happy. I do not like being beholden to investors, at least not to the point where I worry about the IRR. In our world the longer the company performs the longer we hold onto it.

- Hurdle Rates and Internal Rates of Return. Oh are they the same thing? The MBA program’s gift to it students is the IRR – also the biggest myth. I used to take a TI calculator and punch in numbers to get it. Now I just punch in numbers to an excel spreadsheet. I never use it anymore but the hotshot investment banker must use it to calculate the return on a deal sold five years down the road if everything goes great. Of course he had to assume someone invested actual money in order to compute the IRR. So who’s IRR are we talking about? Not the PE firm’s, they didn’t invest anything – the IRR is for the benefit of the sorry investor who gets to take 100% of the risk. What if I did a no money downer and didn’t invest any money, what would be the IRR? Yes the PE firm makes out like a bandit even if the deals they do are bad. Put yourself in the shoes of the PE firm. Raise the money to do the deals, then you will not have to worry about your own IRR, it will be off the charts.

- Financial Modelling. Do we use financial modelling? Of course we do but most of our deals do not have five layers of senior and mezz funding, two layers of equity and fifty or so scenarios of projections complete with sensitivity analysis. Asset based lenders often do not need projections at all. In fact many lenders do not need them, probably because they view them as what they really are: pipe dreams or guesswork. Funny that any prospectus in the public markets would be loaded with great projections even though the subject company has never made a dime in profit. I used to run sophisticated models for deals until I realized it wasn’t necessary, even worse, a waste of time. Now don’t get me wrong we can do them to look pretty but the fancy software is not required. If you understand some key concepts you can run all the required numbers out on a spreadsheet and be done with it. And you will be just as accurate as anyone on Wall Street.

So, in summary, we do get significant benefit from some of the high finance concepts but simplicity is everything when doing a small deal. We do not have to embrace the high tech complexities of bulge bracket investment banks to get a deal done. However, it is useful to know many of the concepts and so that is what I teach — many of the concepts — but only the important ones, not the academic exercises that get you through business school.