Who Do We Serve?

We serve individuals. PEOPLE, buyer of companies, investors in companies. No, not big institutions or private equity groups. We help buyers of companies navigate through the intricacies of sourcing, negotiating, financing and closing a small business acquisition. For those of you who wish to upgrade your career path by becoming an owner of a substantial business, this is for you. You might be a professional looking for a career change, an entrepreneur that wishes to take the efficient route to wealth building or you may be an established small business looking for the next investment. Whatever the situation we work with first time buyers as well as seasoned investor groups, but our first priority is to assist our clients in the acquisition process using the private equity buyout model applied to small acquisitions.

Why Buy A Business Using a Private Equity Model?

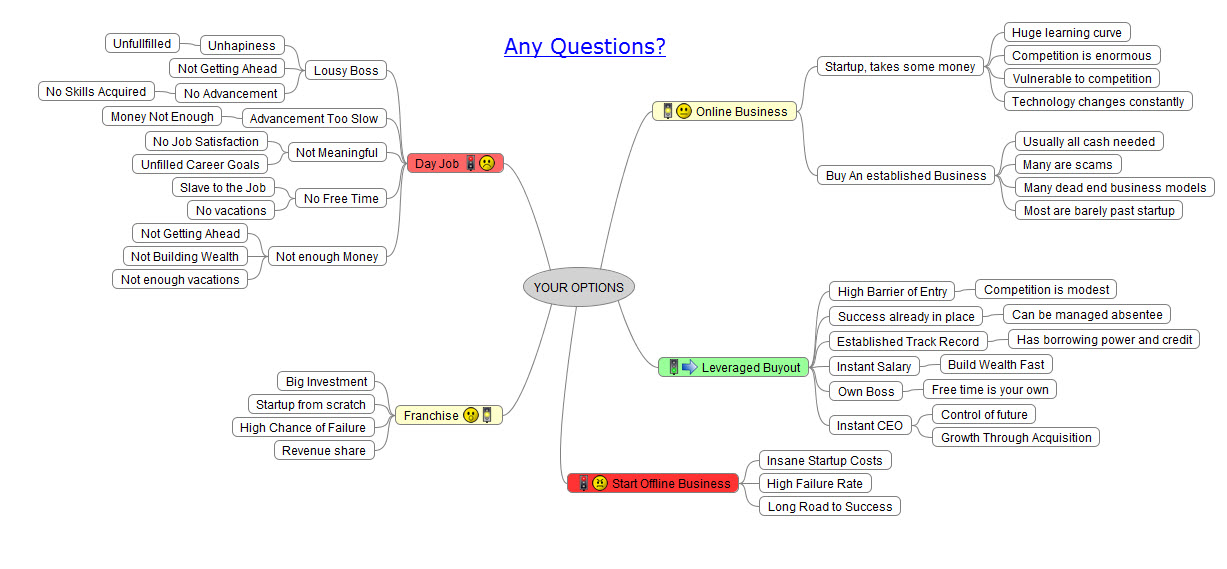

Ok if there are any questions about why you would want to buy a business versus anything else you would ever do then I would refer you to the career options chart on the sticky post. As an online entrepreneur said once, “It will put you ten years ahead of anything else you do”. Lots of people will start businesses, some will mess around on the internet, but relatively few will buy a real business with critical mass in their lifetime. Why so few? Because it can be complicated and it costs money. So we teach and coach how to simplify the process, reduce the costs and greatly increase the odds of successfully buying a business. The buyer can substantially reduce the money needed for an acquisition if he knows the right techniques and process to structure and finance the deal. Enter: The Leveraged Buyout.

What Is A Leveraged Buyout?

If you are on this site and reading this blog I shouldn’t even have to answer this. But here it is. A LBO is a financing strategy, borrowed from private equity, used to acquire a business using its own assets and cash flow to back the loans. This can enable the buyer to finance most of the purchase price while using very little or none of his own money. It isn’t a new technique but it has traditionally been used in very big deals until recently, that is within the last few decades, when banks, lenders and investors became aware of its benefits to buyouts of even the smallest of companies. The fact is everyone is still becoming aware which is why we are in business.

How Is it Different Than Just Buying a Business?

It isn’t, and you can go out and just buy a business. Go ahead, do it. But there are many different strategies and structures available to buy a business. Some are more effective and efficient than others others. The leveraged buyout strategy gives the individual or company buyer the ability to acquire a business that he would never have dreamed possible. It gives him the flexibility to acquire much larger businesses while minimizing the cash outlay.

Can I Buy A Business With No Money?

It is possible, and I have done it more than once in different ways. However, there is a certain degree of luck and timing needed to pull it off. For most people I wouldn’t recommend waiting for a no money downer until they have had the experience of closing a deal. Let us plug the pieces together for you to get a deal done. If indeed you have no absolutely no money and it is your only option, then be prepared to spend more time and go through a lot of deals. If you have no money and no time, then you should continue in a full time job until such time as you can allocate some resources to the effort and/or can pursue a buyout on the side.

What Is This Business Buyer’s Blog All About?

This is the place you go to learn to put together private equity style buyouts, or just plain buy a business and have the best chance possible of pulling it off. This blog is dedicated to training professionals to learn and complete Small Buyouts! The ultimate objective is to educate and provide the community necessary to facilitate acquisitions in the small business market.

What Will You Learn About Buying Businesses?

You will learn far more than an MBA or a college degree could every teach you. You will learn how the small buyer can engineer these deals and buy companies for his own account using PE buyout techniques and strategies. You will learn how to structure these deals so that they are safe and bankable. You will learn how to make any deal into PE buyout, even companies with few assets to leverage. You will learn strategies to build a business, career and a portfolio of companies using these techniques. You will learn how to “Own” companies without having to be employed by them. You will learn how small buyers can acquire a much larger company than they ever thought possible.

What Do I Have To Do To Buy A Business?

Yes there is money involved but that isn’t the catch. The catch is you must be fully committed to the process or you may not own a company after all is said and done. You might, after a halfhearted effort, still be 1000% more experienced and educated than you were before. But the persistence factor is key to the ultimate success of getting to the closing table. However, you will probably spend a fraction of the time, effort and money to be successful at closing an PE versus starting up any other venture– and with far more predictable and lucrative results.

Can I Buy A Business Using These Buyout Techniques?

What isn’t widely known is that LBOs do not have to be big and can be done on very small companies, without needing an investor pool, possibly without outside investors at all. Small and medium sized companies, the ones that are too small for private equity, can be bought by one or more individuals using traditional leveraged buyout techniques. The beauty of it is that the average guy can wind up owning a very respectable, and sizable, company.

Our goal is to bring these sophisticated techniques to the small market. The thrill of the deal, the sense of accomplishment, the prestige of ownership and, yes, the money. These are all in reach to the average businessman. So this is my contribution back to the business community from some rather unique experiences over a lot of years. I want people to overcome the obstacles I encountered, and make sure they have a quick, efficient and profitable trip to the closing table.

Become an Investor in Small Company Buyouts

Whether you are buying a company as a career or just want to invest your money, the returns are right here.

So I’m going to talk about some some of the routine investment options that passive investors are exposed to every day, a passive investor being an individual with a medium high net worth who wants to own part of a small business but does not want to actively manage it.

The average passive investor may have $100,000 to $500,000 free disposable cash to invest and he may not be able to invest it wisely — even if he is a financial wiz! But believe it or not he could own at least part of a small business. And when I say small, it may not be that small. See our Deal Criteria.

.

So here I will go through some of the investment options for the typical investor who wishes to deploy some cash towards a high earning investment. I mean can you really earn 20% – %30? No not with conventional investments.

Investing in Established Small Businesses Is The Best Investment Out There

So let’s take a look at for example at various investment options for anyone, rich or poor. Bank accounts typically pay nothing while CDs pay a little bit more say, 1%, a money market account from a bank or a investment house pays less than that, around 1/2 % per year. The corporate bonds if they happen at the high quality, are paying as much as 5 %to 6% percent while government bonds more likely are paying an area of 2%.

The stock market may be a little higher at 7% over time and maybe a bit more, or a lot less right now. The next step is “fund” type options such as hedge funds which should be getting more than 15% per year but never do. They usually lose all your money and get rich with the fees you pay. Or maybe you can hold onto precious metals such as gold which do well once very recession.

Private equity is the big boy on the block but will they let you in the door? No door, thank you. Still, private equity does as much as 33% per year IRR – of course than bad ones that don’t do that that much but at least collect management fees so that they can achieve far greater returns than their investors.

But that may not be the easiest thing to get into so you might be better off investing in commodity stocks such as coal oil, copper, steel, coffee etc, etc — No?? Oh that’s right the commodity prices have crashed. Well there is always the rebound.

Then there are REITs – which are real estate investment trusts that pay up to 10% dividends so of course those are going to be of the higher end of the return assuming that they their real estate portfolio doesn’t go down the drain such as the way it did in the seventies and the eighties and just about every decade since.

The Real Investor Returns Are In Real Businesses

The investments we structure are totally different than straight private equity limited partnership units in which the limited partner is a faceless spec among big money players. For any investor the PE model is kind of like putting you money down a black hole for 10 years. Rather our buyouts are of the kind that are single or double investor transactions where the companies owned and closely held and the investor owns a significant share of the company.

So finally, when we cut through the rest of the bad investments, we are back to a small investor of leverage buyouts, with superior and consistent returns over long periods of time. OK so here is what we do and how we differ from private equity in the following way:

- We don’t take on a ton of investors with diluted ownership, we take no more than a few at a time with large individual stakes in the companies.

- We don’t take on big money with a 10 year horizon to do deals, we pay out the investor over a few years and he remains an owner after that.

- We don’t let investor dollars into a transaction unless we have to and when we do they are legitimate partners of a closely held corporation.

- We don’t rip our investors off with huge fees, the investors gets to participate in the cash flow of the deal.

- We provide liquidity in the transaction, coupon returns like a bank and cash returns on an immediate basis.

The biggest benefit is paying a cash on cash return from the day the deal is done until the day the investor gets his money back — and that cash on cash return can be 8% or as high as 15% depending on the transaction. Paid just like a bank savings account, except obviously not federally guaranteed. In addition to the cash return, or as we call it the coupon, there’s also a proportionate amount of ownership that is available in the deal. In many cases there are perks and expenses and consulting fees which are available to the investor.

So passive investors can make superior returns in these transactions just from the fees and remuneration that will be paid along the way. Yet the big killing can be from the sale of the business at the end of the holding period. In addition to the return of capital the growth of the ownership interest can be substantial. If private equity can get you 33% from owning a tiny fraction of a big company, trust me, owning a healthy minority interest in a strong small to medium sized company can do just as well and probably a lot better with far better liquidity.

So that essentially summarizes the universe of investments that are available to a passive investor. When you take the internal rate of return of any of these investments and compare it against a small buyout, there’s really no comparison at all.

In fact a small business leveraged buyout can create rates of return that are nearly off the charts compared to conventional investments. Thus it makes sense for an investor to consider the options of small businesses as a means to enjoy superior returns in a lagging economy and volatile stock market.

Rockwell Marsh

Signal Hill Holdings, LLC