Unfortunately most businesses have some kind of debt on the statement. Buyers don’t always know what to do when they see it. When I say statement I mean financial statement and by that I mean balance sheet. Most companies have some sort of loans, liabilities, or other types of contingencies on the balance sheet. It comes with the territory. This is what happens when you own a business. You are almost certainly going to have some liabilities on the balance sheet. But what effect do those liabilities have in a sale of the business? In fact the effect is dramatic and may well interfere with or even break up the deal. So how to buy a business what has debt or what to do when you encounter one?

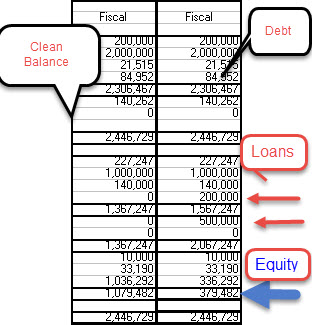

So first, let’s figure out what we are talking about when we say debt. I keep driving the debt point home because the debt is critical in your plan to acquire a business. Most companies do not have perfectly clean balance sheets. It is generally considered a perfectly clean balance sheet if only operating assets and liabilities are present. That means if you have accounts payable for liabilities and nothing else you’re in pretty good shape. But accruals typically happen as well. So if you have accrued taxes or accrued expenses this is also normal for a small business balance sheet. So the typical balance sheet will have assets, including accounts receivable, cash, inventory, fixed assets and the liability side will have accruals and accounts payable. For our purposes this is pretty much the definition of a clean balance sheet.

Is it ever this simple? No it never is – balance sheets usually are not given to us completely clean. You will always encounter the statement that will have a few car loans, a few leases, real estate loan, or even loans that are much larger. It is these loans that you must be concerned about. The loans are typically called “funded: debt. “Funded” that is a term in LBO speak meaning that the debt is outside operations and is typically advanced by a third party lender. It could be interest bearing debt, or not. However, this debt it always gets into the way of the deal.

The reason for this is simple. The debt must be paid off at closing. Most debt it is not assumable. While accounts payable and accruals are easily assumable with the acquisition of the company, bank debt, leasing debt, and most other types of loans are not readily assumable without the permission of the lender. Thus the easy way to handle debt on the statement is to simply pay it off. But who pays the loans off? Whose money actually does the payoff and gets the loans off the books?

This is what needs to be looked at. A significant cash down payment is usually supplied by the buyer. I say usually because sometimes the down payment isn’t all that significant. But the down payment could be as little as 1/3 of the total valuation to as much as 2/3. We never do a deal without some seller paper. Even if the SBA is involved.

So, let us take an example. Let’s say the down payment of a deal was negotiated for $500,000 and the funded debt on the statement, in addition to the operating accounts, was about $200,000. In that case $200,000 of that $500,000 down payment would have to go towards paying the debt off before it would ever get into the seller’s pocket. Otherwise the collateral and assets cannot be delivered free of clouds or liens.

So if you think you’re putting $500,000 into the seller’s pocket you are mistaken. The seller is only really getting $300,000, while you think you are giving him $500,000. This can create not only miscommunication, but a breakdown in the deal. In fact you should be anticipating this problem whenever you see ANY debt on the statement beyond the operating liabilities. You should always be looking at the level of debt on the target company’s statement.

This goes directly back to the valuation process. A valuation must be done on a clean balance sheet and assuming all debt has been paid off before closing, not during closing. In order for the valuation to make sense, you and seller would need to be in agreement that a $500,000 down payment would be appropriate assuming his company had no debt on the balance sheet.

If the seller is trying to get greedy and add another $200,000 to the valuation, then he will insist that the buyer pay off the loans and then pay another $500,000 on top. This would mean the down payment would be $700,000 to the buyer, even though the seller only gets $500,000.

So as you can see the valuation can easily get hiked up in these circumstances, if the seller insists on the buyer picking up the tab for the debt. So when it comes to how to buy a business with debt, make sure you eliminate all debt when looking at the valuation and structuring an offer.

However, the buyer has a very strong argument against doing this. Most Sellers pay themselves handsomely no matter whether their business can support it or not. If it can then they will often take out more debt to accommodate salaries, bonuses and other remuneration. When loans show up on the balance sheet, it usually means they cannot be paid off because something else is using up the money. Namely the seller. So the easy argument to make is that the seller has already used the money that was borrowed on the balance sheet. And for his own purposes. So we don’t accept any notion that the debt is ours to pay. Saddle the seller with those obligations.