This blog deals mostly with buying offline businesses, or as they call them nowadays, bricks and mortar businesses. Buying an offline business is the traditional approach with its own strategies and metrics. I teach a segment of that in the bigger markets(LBOs) but also we tackle smaller traditional deals as well. Yet I simply cannot exist in this business world without running into plenty of online businesses to buy. It is a fact of life. So I will now provide an in depth comparison between buying an online business versus buying an offline business.

We are now in the 21st century and we need to understand how online businesses fit into the traditional marketplace and vice versa. We need to understand how the online world can help improve offline businesses. We also need to understand how the underlying durability, stability and core structure of the offline business can be at the cornerstone of an online marketing strategy. In fact the two business environments can be merged but that is a brand new concept and has not played out yet. The entire process of buying an online businesses is simply a different experience than buying an offline businesses and I will get into it in detail.

Balance Sheet Differences

Let’s take an online business for example. There are almost never any assets to buy, at least hard assets, in an online business. The domain may be considered a valuable asset and the inventory may be worth something, but there are no receivables and there are no fixed assets. There is also rarely any real estate. There is no heavy duty equipment and usually all cash is completely out of the company.

This is actually one of the advantages of taking credit cards on the Internet. You get paid instantly and the money goes into your pocket and off of the balance sheet just as fast. The problem is that a lack of any hard assets can be a problem when buying an Internet business. There simply isn’t a reliable financing mechanism in the marketplace other than venture capitalists that are usually interested only in the next Google wannabe.

But fortunately there are a million tiny websites which don’t cost much to buy though they could barely be called small businesses. The sites that cost 12,000 or $20,000 and earn a tiny monthly living are not difficult to pull off. Most people can put together that kind of money in cash. In fact seller paper is very common but with short term maturities. But once you get into areas that are in the six figure range, it isn’t so easy to finance these sites.

In fact an online business that costs $200,000 to $300,000 is now competing with a similar sized offline business for its buyers. The buyers may well have a much better chance to finance a $300,000 offline business, because the offline business will often have a physical location, physical assets, receivables, inventory, and real estate. All this constitutes bankable assets which can make a small leveraged buyout very easy for the bricks and mortar business. In other words, the bricks and mortar is worth something to bankers whereas the online digital assets…. well not so much.

Financing Differences

So now we have all of these online businesses what do we have to do to acquire them. In that regard there is a certain amount of good news. In the longer term, the lenders in the marketplace will certainly catch up and develop new products to accommodate the purchase of online businesses. Right now the market is new and lending, mostly unsecured money, to new technology and to very small companies is a tenuous prospect for lenders. The loan products simply aren’t that suited to the purchase of online businesses just yet.

That doesn’t mean it’s impossible to finance one of these deals, but it does mean that a lender will rely far more on the purchaser then on the acquisition. Traditionally our leveraged buyouts rely mostly on the acquired company. By rely I mean the lender will rely on the collateral and credit strength of the appropriate entity but… A small web site earning a few thousand a month and having started up a couple of years ago may not be the optimum bankable entity. So pull out those credit cards because the actual prices aren’t that high.

While traditional banks, asset based lenders, one stop shop and hard money lenders will go for a wide range of traditional business acquisition deals, the online world is not so easy. The SBA and its typical lenders are only gradually getting used to having no assets to lend against.

The new breed of alternative lenders are, however, starting to materialize. Merchant lenders and crowdsourcing lenders are making limited amounts of capital available to acquire web-based businesses. Just realize that the old leveraged buyout depends on the target company for its credit strength and collateral, while the new breed would prefer that you individuals back the loan personally. So it is a good thing the loans for these websites can be on the small end of the scale.

Online Learning Curves

While the difficulties of financing the online buyout are one problem, the technology is another. With an offline business, you can usually learn the trade that fairly quickly with not a great deal of effort. If the business distributes products, you learn the distribution and sales methods. If the business manufactures something you learn the manufacturing methods. With an online business, you may well learn all the above plus you must be familiar with the nuances of a complex technology related to the Internet.

If you think getting up to speed on internet businesses is easy, think again. The business model itself may be extraordinarily simple but the mechanics of websites and online architecture is rather complicated and changing constantly. For example, with an offline business you sell a product and make money. If you sell product in a store people walk in and buy it. If you sell products online you really need to understand websites, marketing channels, design, graphics, content creation, traffic, conversions and a lot of other things related to the Internet. So there is a significant learning curve that you need to embrace when entering the online arena.

Online/Offline Valuation Differences

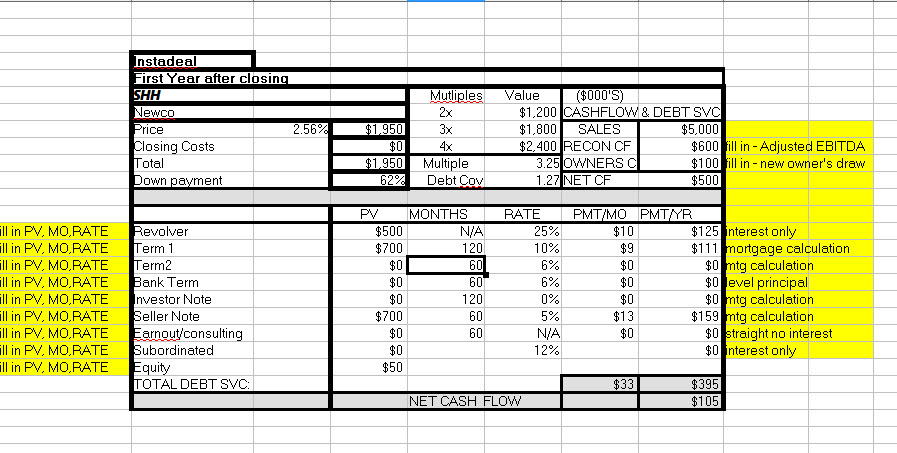

So let’s talk a little bit about the price of these businesses. Amazingly, as the above video shows, the cash flow and sales numbers can often be very similar between online and offline, despite the often great diversity in business models. Additionally the valuation multiples can be very similar. Small businesses that command 3x cash flow in the old world often command same multiples in the new world. One will find that there are many more businesses at the microscopic level in the online world than there are offline. There are home based businesses in both worlds but offline businesses quickly grow out of the home once they require employees and other infrastructure.

Tiny online businesses are often priced as a multiple of monthly profit rather than annual profit. This means you will see deals priced a 15x, 20x or 25x for example. The $1000 a month website at 20x will be priced at $20,000. This isn’t such a bad deal by offline standards. It is actually about 1.5 times cash flow. When you see offline businesses as small as this you may well see these tiny multiples as well. As the deals get bigger you will see the on-line deal diverge from the offline deal. The online deal may well command a two multiple versus the off lines three multiple. So the offline business will always have some degree of premium versus the online business which really can be attributable to the typically larger size, barrier of entry, longevity and developed infrastructure.

So if the multiples are somewhat lower on the online businesses then what about the deal structure? Well, this is a very good question. Traditional businesses will have more assets and thus be more bankable, which will become more important the higher the price tag. This will enable the buyer to finance the deal and put down more cash than with a similar sized online business. Seller paper will usually be much longer term on the traditional deal and shorter term with the websites. You can still do some seller paper on websites but it will usually be as little as 30 days and probably not more than a year or two at the longest. The good news is that the multiples are usually low enough that you can pay the paper back that fast.

On offline deals I have done deals with seller paper as long as ten years, usually with a fair amount of assets in the deal backing that length of term. That is on the very long side, and usually the average term is going to be about five years on the paper. All in all the length of the paper and deal structure will always reflect the risk. The smaller online businesses are riskier and cheaper while the bigger traditional businesses are less risky and more expensive.

Scalability Differences

The internet phenomenon continues to remove nearly all the barriers of entry and promotes extreme competition and a commodity environment where everyone is selling the same product and the winner has the lowest price. However it can have one major advantage that offline businesses do not always have. And its a real buzzword: Scalability.

These days you want your business to be scalable. That means you can crank up the sales with pretty much the same system and resources. The process can be relatively painless with an online company because with the same 2-4 people on your team you can increase sales from $300,000 to $2.0 Million in short order. Many of the businesses we see in ecommerce get to seven figures in a few short years. The online business can usually sell to the whole world.

Traditionally speaking, you cannot expand your dry cleaner from $300,000 to $2.0 Million without adding some major resources to the equation (e.g. another location in another city etc.). Many offline businesses cannot scale without hiring sales people, adding locations or doing something major to their businesses.

So Which One Would We Want to Buy?

So the difference between these two types of companies can be summed up as follows. The online business is vulnerable to competition, has no barrier of entry, and has a learning curve associated with that that is difficult to master. With an online business you don’t need employees, you can just create a virtual team with contract labor. In fact it can be a much simpler business model because it is not nearly as labor intensive as a traditional business. You can even handle the whole business yourself.

The offline business can be local in nature, with higher barrier of the entry and is usually easier to master, local employees. Will it grow as fast as the online business? Probably not. But it will usually be far more sustainable. The offline business has the advantage of stability, defensible nature , and usually a much greater net worth with stronger balance sheets.

Up until recently traditional businesses have been utterly ignorant on how to harness the internet to help them. At the same time online businesses and their entrepreneurs have been utterly ignorant of the sheer existence of traditional businesses. It is like they come from two different worlds. But each has its own strengths and that should be taken advantage of. I have seen badly antiquated offline companies become so internet savvy that their entire business changed overnight with sales, margin and profitability increases that would amaze even internet techies. Similarly online businesses that simply stick to online sales may do fine, but may well be missing out on a massive offline business segment if they would only put boots on the ground.

So I would recommend looking at both, and when you look at an online business think about what type of offline sales channels would exist and when you are looking at offline business, look at the possible online marketing opportunities that would enhance the current sales levels. I am still more comfortable in the offline space because the online space is still the wild west and is loaded with scams and businesses that can disappear overnight. But in the near future more an more companies will be compelled to become hybrids using both offline and online components to maximize their growth.